Focus Over Sprawl: Pepsi’s Bottling Dilemma in the Cola Wars

PepsiCo is under mounting pressure from activist investor Elliott Investment Management to simplify its business model. The investor has urged Pepsi to consider spinning off bottling operations, pruning sluggish brands like Quaker, and reallocating resources toward stronger growth categories. Although management has not formally committed to these steps, Elliott’s campaign has elevated refranchising and restructuring as credible strategic options.

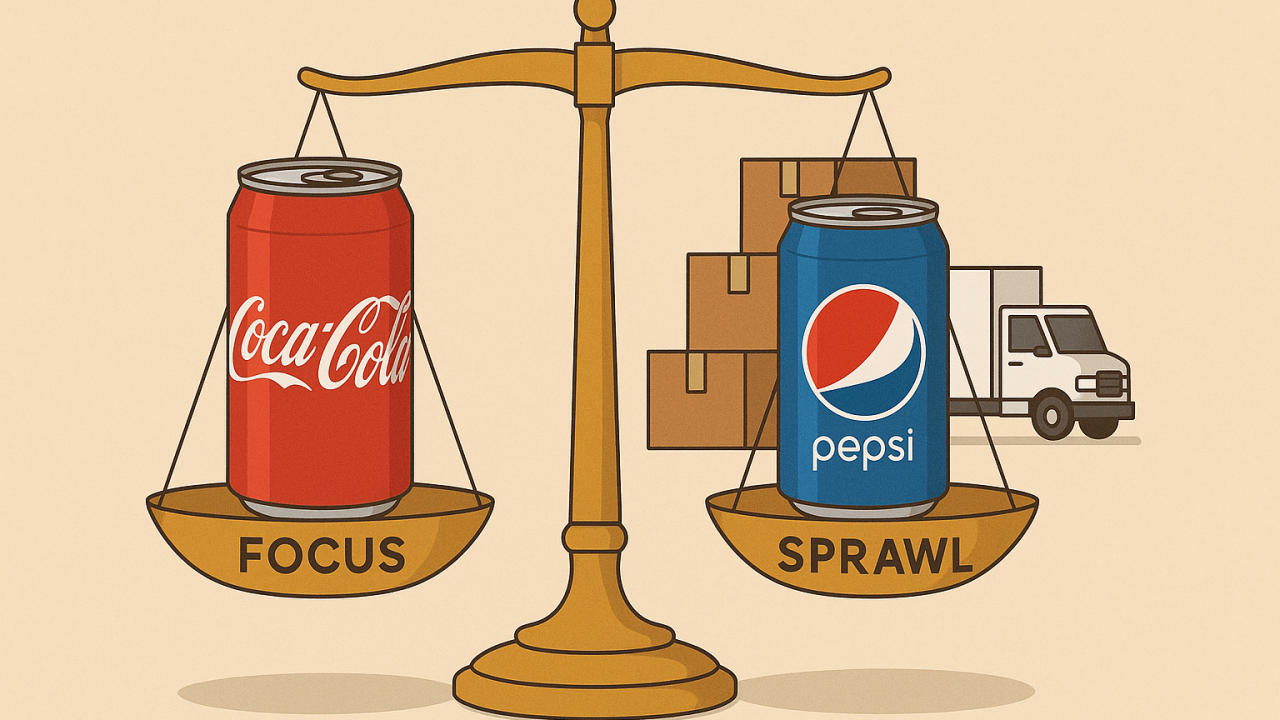

Pepsi faces a structural disadvantage compared to Coca-Cola. Its beverage margins have eroded because it still owns capital-heavy bottling and distribution, while Coca-Cola outsourced this function years ago. At the same time, Pepsi’s snacks business, long the profit cushion, has seen slowing volumes, making the weakness of its beverage unit more visible. The result is a “conglomerate discount,” where Pepsi’s stock trades at a lower multiple despite generating more total revenue than Coke.

The objective behind pruning bottling and weak brands would be to streamline Pepsi into a leaner, more focused consumer company. Shedding capital-intensive operations could lift operating margins, while redirecting funds to marketing and product innovation could revitalize the Pepsi brand. If successful, this would narrow the valuation gap with Coca-Cola, whose asset-light strategy and disciplined brand spending have helped it sustain higher profitability and a richer P/E multiple.

This case illustrates a recurring strategic lesson: diversification and vertical integration can become liabilities when they dilute focus and weigh down profitability. The classic Cola Wars case (Yoffie & Kim, HBS 2010) shows that Coke and Pepsi sustained high profits for decades by controlling concentrate economics and shifting costs to bottlers. Coca-Cola’s later decision to refranchise bottling initially hurt margins but ultimately delivered stronger profitability and brand focus. Pepsi resists a similar move, arguing that keeping bottling in-house enables better customer service, faster product launches, and more promotional flexibility. Yet, as Professor David B. Yoffie e notes in the case, there is little evidence that such integration creates lasting strategic advantage. More broadly, Wall Street wants focus: Kellogg split snacks from cereal, Dr Pepper is separating coffee from soda, and Kraft Heinz is carving meals from condiments, only to see its shares slip 5% after the announcement. Pepsi now faces the same crossroads. The broader lesson is that in mature industries, firms must continually reassess scope, structure, and focus, often absorbing short-term pain to capture long-term gains in profitability and market valuation.